Worcester Fund

Key Highlights

Zero management fees

Target return 9-12% cash-on-cash-return (COCR)

13.87% since inception total return (realized + unrealized gain)

9.40% since inception average annual realized COCR

8% preferred return

$50k investment minimum

Tax incentives through depreciation

Diversification across several assets

Projected use of new funds

Last year, we closed $45.5M of apartment acquisitions and $5.8M of private loans. As a result of new money coming into the Worcester Fund last year, the Fund invested $3.3M in private loans averaging 10% interest returns (57% of available loans) and $4M in apartment equity opportunities (~20% of available equity per deal). By participating in these opportunities we were able to further diversify the fund, achieving our targeted 50/50 split between equities and debt, and bolster the portfolio of the fund with strong investment opportunities.

Our goal is to grow the fund, allowing us to participate in more deals and increase the strength of the Worcester Fund portfolio. Our acquisitions team is targeting $75M in new deals this year, and our Private lending team is targeting $13.2M in new loans as the market and quality of opportunities allow. In conjunction with those goals, we have determined that the Fund would benefit from at least $5M of new investor capital in 2024. We always want to position the Fund to be in a great place (prepared) for opportunistic investments, and one of the ways we can do that, is via new investments from our investor-partners.

Summary of the Worcester Fund

The Worcester Fund was created in 2017 to provide our investors with a diversified investment vehicle focused on strong, dependable, and risk-mitigated real estate-based income. The Fund is invested in multiple real estate deals, allowing fund investors to participate in all the benefits of real estate ownership, such as predictable monthly income, gains on asset appreciation, and tax advantages.

No Management Fee

To the best of our knowledge, the Worcester Fund is the only fund with no management or related fees. If we charged a 1-3% fee (consistent with the marketplace), we would be out of alignment with our investors’ interests. We only participate when the fund meets or exceeds its return expectations, aligning us with investors (see more below).

Preferred Return

There is an 8% preferred return associated with the Fund. Any performance up to 8% goes entirely to the investors. Returns above 8% are split according to their class membership (as displayed below), aligning our interest with investors.

Post-Pref Split Tiers (Class Memberships)

Class A (>$1mm invested) 70% to investor, 30% to Worcester

Class B ($500k-$1mm invested) - 65% to investor, 35% to Worcester

Class C ($250k-$500k invested) - 60% to investor, 40% to Worcester

Class D (<$250k invested)- 50% to investor, 50% to Worcester

Fund Strategy

We follow a conservative acquisition approach that heavily emphasizes buying attractive multifamily properties below their intrinsic market value and private loans in a conservative loan-to-value (LTV) position. We leverage long-time relationships, our 120+ employee team, and extensive market expertise to create maximum value from each investment. The Worcester Fund has a first right of refusal on all Worcester opportunities. Since our target returns are 9-12%, the Fund focuses its strategy on loans and equity opportunities that align with or exceed those return expectations.

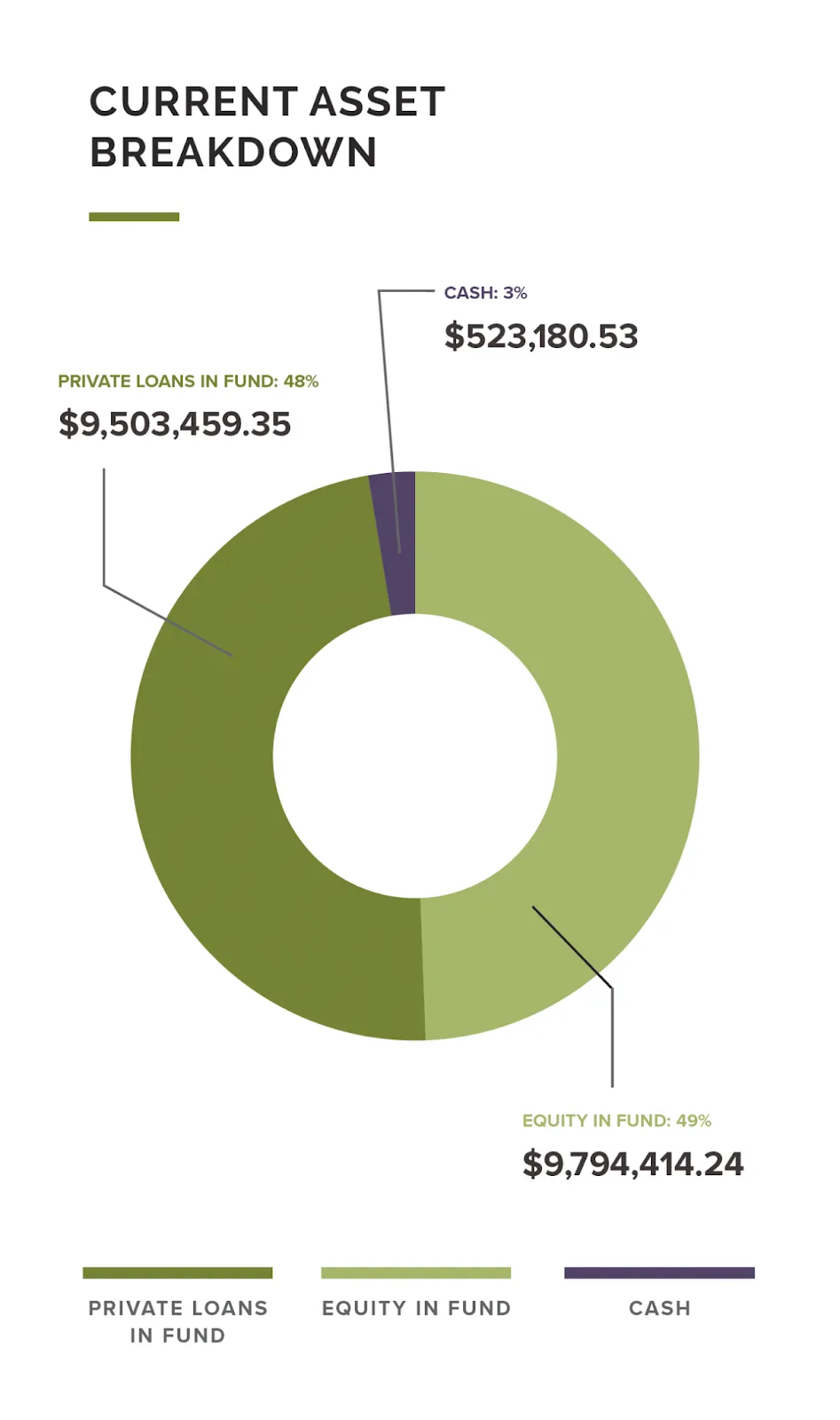

Fund Asset Breakdown

The Fund provides a well-diversified mix of private loans and equity opportunities. Our private lending concentration makes up 48% of the Fund’s investments, while equity makes up 49%, and cash 3% totaling assets under management of $19.8M.

Private Loan Holdings (Managed by Worcester Financial)

Worcester Financial is an asset-based lender offering our investors an 8-12% return on their investment over 12-18 month terms. We like to say, “We only lend on what we would want to own.”

We generally lend up to 70% of the after-renovated value of the collateral. Worcester’s extensive experience as a real estate operator uniquely positions us to get top value from an asset if the borrower defaults. Whereas banks make their best effort to recover collateral, often taking a loss, we’re positioned to finish the project if necessary and obtain top value. The Fund currently has over $9.5M invested today in private loans, generating an average return of 11.72%.

Equity Holdings

Worcester Investments has transacted on over 5,000 apartment units throughout the Midwest. The Worcester Fund is currently participating in 9 of its equity deals, with plans to increase this number in 2024, expanding into more equity opportunities as they become available.

Track Record

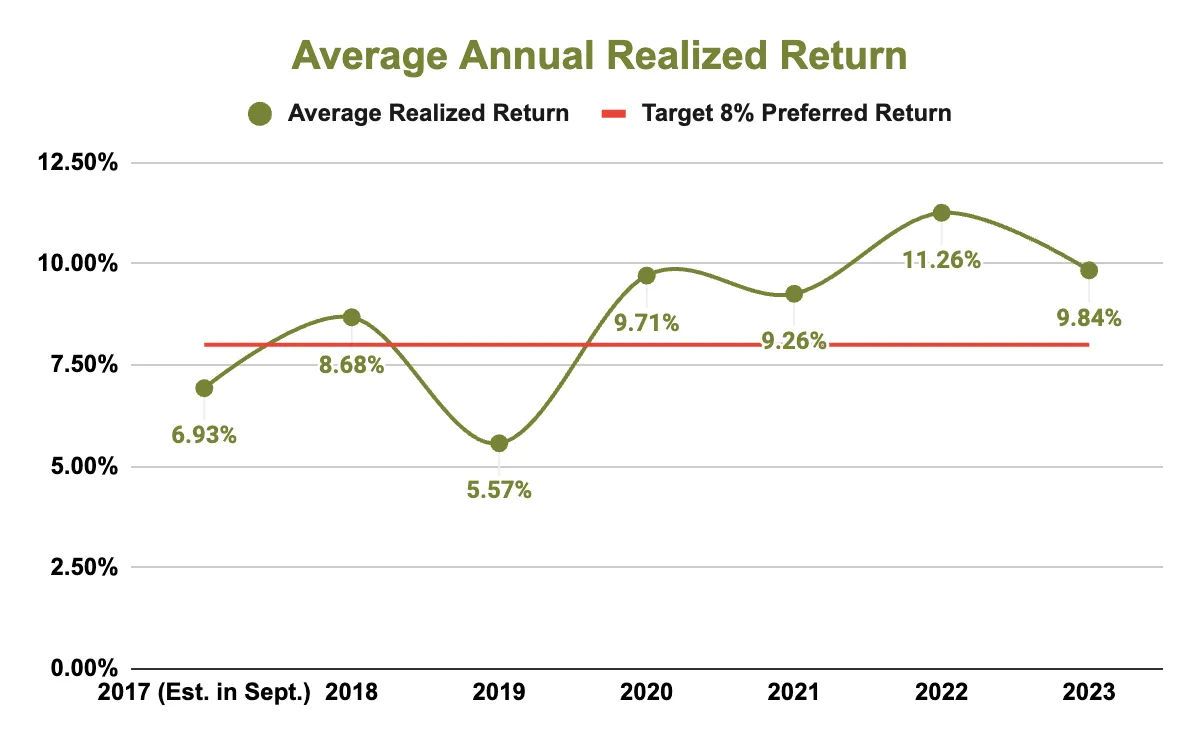

The Fund has boasted a 13.87% average total return and a 9.40% average annual realized return to investors. During the first few years of the Fund, the first real estate assets were in their early investment stages. New acquisitions typically take 1-2 years to stabilize and cash-flow. With 7-years of operating, the Fund has achieved a strong baseline, generating predictable returns for investors.

Please see the below chart for an illustration of the average annualized realized returns.

2023 Investments

In 2023 the fund grew 50% in total assets under management. With the swell of new investors coming into the Fund, we were able to leverage into larger positions in our apartment opportunities as well as invest in more private loans. Please see what the fund invested in 2023 below.

Westlink Village

The Fund invested $2,015,893.66 in a 240-unit apartment complex in Wichita, KS.

Projected Returns

7% Preferred Return

10.88%+ Before-Sale Cash-on-Cash Return (COCR)

33.07%+ After-Sale Cash-on-Cash Return (COCR)

2.86x Equity Multiple

15.45%+ Internal Rate of Return (IRR)

Maryland Park

The Fund invested $2,000,000 in a 252-unit apartment complex in St. Louis, MO.

Projected Returns

8% Preferred Return for investors

11.24%+ Before-Sale Cash-on-Cash Return (COCR)

40.05%+ After-Sale Cash-on-Cash Return (COCR)

3.48+ Equity Multiple

17.64%+ Internal Rate of Return (IRR)

Investment Opportunity

As mentioned above, the Fund can accept up to $5M in new investments and can subscribe new capital quickly. If you are interested in learning more about this investment, we encourage you to watch the webinar, as well as reach out to us directly for any questions.

If you have any questions or would like to discuss this opportunity in more detail, please feel free to schedule a call at a time that is convenient for you below.